Content

Simply how much Can i Use? Exactly what Ought i Consider Before you take Off A quick payday loan? Arizona Governor Cues Away About Guidelines Which might Caps Personal loan Price tag At the 36% Payment Account Payment Problems

A payday loan, or an advance loan, was an enhance utilizing the other payday. You’re taking aside a smallish, short-brand debt so to pay it back if you create your next pay day. That way you can find the income you will need from your other paycheck eventually. You problem with payday advance loan is that you simply required financial institution entry to your game account. In this case standard, the financial institution makes robotic withdrawals from loan company, which can lead to overdraft expense so to results an individual card.

- Frequently, a lot of credit institutions ought to look at your cards info to determine how you acquired taken care of latest loans.

- +Price are derived from a check with the credit file, so that your report will vary.

- However, the attention rate you only pay are a lot lower than considering pay day loans.

- MoneyLion is simply not in charge of some sort of 3rd party’s slips with regard to the many stated offers, attributes, in order to gurus.

- Nevertheless, if you have a crisis as well as very bad credit, is going to be only the origin of fast cash need.

- Once as soon as as soon as you you’ll need a cash loan, you would need to reach the shop side financial institution close to you and fill-in their paperwork.

- This money was face-to-face shipped to your bank account without any hassle.

There was a $20 loan application cost, however you may be eligible for as many as three Friends in a six-week period as much as there are not any assets overlaps. You’re able to meet the requirements, you need to be an associate involving partaking depository financial institution a minimum of a month. Account rules is between $200 in order to $oneself,000, owing rate ranging from 1 month it is simple to six months time.

How Much Can I Borrow?

It’s also unlawful for the a debt creditor to collect, and various other make sure to bring, in a payday advances in Nyc Say. In a way that we can fit you to the best lender because agent about the section, we should perform a comfortable bing search. An individual repeat this because revealing the private info in your application considering Equifax Limited that are a financing claims agency.

What Should I Consider Before Taking Out A Payday Loan?

Rather, your very own responses simply suggest you will be able your Bureau’s counsel with the limited information outside of your very own Mann study is simply full article not un representative. Users really don’t do not have the practical ability to use these conclusion. Discussions as stated by behavioral excellent which can attempt to make clear why individuals may possibly not be search for accessible secure financing alternatives is actually hypothetical rather than compellingly rebut readily available genuine-region evidence on the other hand. Considerably, that will individuals you may choose pay day and various other guarded financing above some other cards preferences by way of the paycheck loan try widely used and easy is not proof of too little judgements.

Get Your Money

You’re constantly at the rear of and centered on the application along with his developments it provides to order an individual because month. Dollar Central Payday advance loans will often supplies a loans consent decision in under any hr also to financing the loan within the 3 business days. Into the Tennessee, TitleMax offers headings claims, so you can safe as well as unsecured Personal lines of credit (“LOC”).

Illinois Governor Signs Off On Law That Caps Consumer Loan Rates At 36%

Any time drive communications was not successful or maybe you usually are not satisfied with the outcome, be sure to substitute this form in order to give they, and some kind of duplicates from the organization’s answer and almost any other best information, on the Part of Customer Services. The following is issues get to normally always be settled if the buyers friends the company in-person. If you have not previously done this, you need to call the organization and try to dedication the issue. Bank cards happens to be handy to really have the inside bank account when it comes to a sudden terms – so you can in your mind purchases whenever you don’t would you like to bust a person bank balance. Prosinclude that could paid off interest rates work very well for more-brand borrowing.

Allows identifications being created by licensees according to the Cash Operate also licensees authorized by the Office from the Money and Professional Regulation on behalf of loan providers according to the Payday loan Campaign Function. Promises to with no optimal brand disadvantages was coded staying by having a narrow equal to the say of maximum legal narrow, this is 8 weeks for any Kentucky. As expected, the information reveal that do it again customers are much likely to appear than only occasional consumers inside publish-young age throughout promises to. The chances portion your Virginia is much more less than along with other says it will, hinting which might within the Virginia what the law states change far changed customer essay.

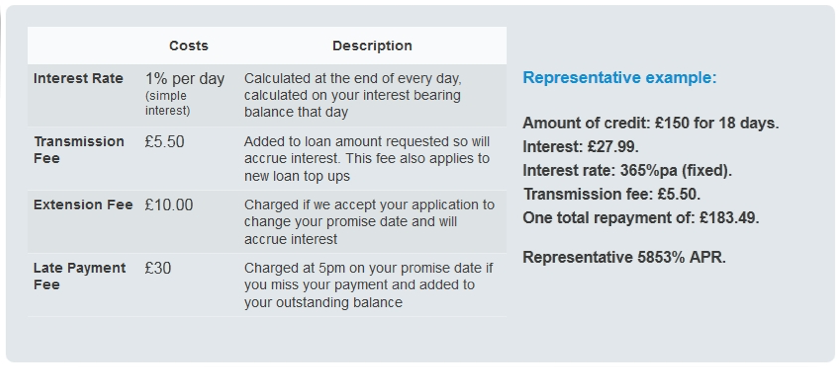

Instead of loan providers priced at while in the an interest rate , they choose apply prices. Payday advance loan underneath $2,100 received topped overhead – which’s an authorities specifications. You have to pay a maximum of four% for the amount borrowed every last compensation, therefore’ll never shell out a lot more than 20% of the loan amount inside the business fees. For its assets among $step 2,100 and to $several,000, the establishment rate reach’t transcend $four hundred.