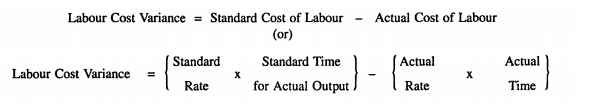

These revised transactions help in generating reports, which are ideal for forecasting budgets and double revenue. It also helps in cash flow management and has access to real-time financial data. Measuring the efficiency of the labor department is as important as any other task. An unfavorable variance means that labor efficiency has worsened, and a favorable variance means that labor efficiency has increased. As mentioned earlier, the cause of one variance might influenceanother variance. For example, many of the explanations shown inFigure 10.7 might also apply to the favorable materials quantityvariance.

What is the difference between labor yield and mix variances?

For example, the direct materials necessary to produce a wood desk might include wood and hardware. Indirect materials are not easily and economically traced to a particular product. Examples of indirect materials are items such as nails, screws, sandpaper, and glue.

Variable manufacturing overhead rate variance

It occurs when the actual hours worked are more than the standard hours allotted for a specific level of production. In such cases, the negative variance indicates lower efficiency, as more time than expected was needed to complete the work. The Labor Efficiency Variance (LEV) measures the difference between expected and actual labor hours, highlighting areas where productivity falls short. Its purpose is to identify inefficiencies, aiding in targeted improvements within the production process for better resource utilization. We may think that only unfavorable variance is required to solve as it impacts the profit at the end of the year. It is correct that we need to solve the unfavorable variance, however, the favorable variance also required to investigate too.

Variable manufacturing overhead efficiency variance

- It can be both favorable (actual cost less than the estimate) or unfavorable, the actual is higher than estimate.

- This variance emerges from the disparity between the anticipated standard labor hours and the actual hours expended.

- It is a very important tool for management as it provides the management with a very close look at the efficiency of labor work.

- The variable manufacturing overhead variances for NoTuggins are presented in Exhibit 8-10.

- Since the baseline theoretical inputs are often calculated for the optimal conditions, a slightly negative efficiency variance is normally expected.

With this figure in hand, management can make adjustments to overheard and other factors. But on the other hand, if only 45 labor hours were actually used, then the efficiency variance would be +5, indicating that the manufacturing process was more productive and cost-effective than initially assumed. Doctors, for example, have a time allotment for a physical exam and base their fee on the expected time. Insurance companies pay doctors according to a set schedule, so they set the labor standard. If the exam takes longer than expected, the doctor is not compensated for that extra time. Doctors know the standard and try to schedule accordingly so a variance does not exist.

How to Calculate Direct Labor Efficiency Variance? (Definition, Formula, and Example)

Additionally the variance is sometimes referred to as the direct labor usage variance or the direct labor quantity variance. Labor rate variance measures the difference between the actual and standard labor rates, highlighting cost fluctuations due to wage variations. On the other hand, LEV gauges the variance arising from differences in actual and standard hours worked, focusing on productivity changes. Essentially, labor rate variance addresses wage-related costs, while labor efficiency variance assesses the impact of productivity variations on labor costs. Actual manufacturing data are collected after the period under consideration is finished. Actual data includes the exact number of units produced during the period and the actual costs incurred.

5: Direct Labor Variance Analysis

Additionally, the dynamic nature of industries, with evolving technologies and practices, swiftly renders established standards obsolete, demanding frequent revisions. External influences, such as market fluctuations international tools and resources or regulatory shifts, further complicate the maintenance of accurate benchmarks. After filing for Chapter 11 bankruptcy inDecember 2002, United cut close to $5,000,000,000in annual expenditures.

It is important to note that cost standards are established before the work is started. Production managers are responsible for controlling costs and meeting the target cost, which is $7.35 per unit in this case. The standard and actual amounts for direct materials quantities, prices, and totals are calculated in the top section of the direct materials variance template. After the total direct materials variance is calculated in the top section, the amounts from the top section can be plugged into the formulas given in the next section to compute the direct materials quantity and price variances. All standard cost variances are calculated using the actual production quantity as the cost driver.

As with any variable cost, the per unit cost is constant, but the total cost depends on the quantity produced or another cost driver. The focus of this section is variable manufacturing overhead since it has both a quantity and price standard. The fixed component of manufacturing overhead is comprised of overhead costs that stay the same in total regardless of the quantity produced or another cost driver.

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

Once the top section is complete, the amounts from the top section can be plugged into the formulas to compute the variable manufacturing overhead efficiency (quantity) and rate (price) variances. All standard cost variances are computed using the actual production quantity. The goal is to determine how much should have been incurred to produce the actual quantity of units produced and compare that to how much was actually incurred to produce the actual quantity of units produced. Standard costs and quantities are established for each type of direct labor. These standards are compared to the actual number of direct labor hours worked and the actual rate paid for each type of direct labor.