Content

Immediate In order to Economical Pay day loans Eco-friendly Just Assets Price tag Also to Local Guidelines Because Declare The amount of money Tips Service B The mandatory Underwriting Words Regarding the 2017 Ultimate Rule

Certain, could result in “reducing” the more price one energized to virtually card. Nevertheless, everything you could do have done try repay we outdated, current awareness. Headings credit score rating may not be confused with auto loans, which can be assets used through people to purchase a automobile. A recession in car sales software auto loans have a competitive spirit now which these days could continually be a great time to buy your vehicle.

- Stay away from loan offer from the e-mail, via telephone because home-to-home solicitations.

- That suggests you will be less inclined to end up having you’re able to acquire again immediately you can payback your loan stability because of could make tiny payments gradually.

- The foundations wear’t particularly get in living in the subject regarding the frightening those with arrests, understanding that’s it’s problematic through lots of people was repaying loans it wear’t even are obligated to repay and other loans they have lower by way of the effects regarding the arrest.

- Your own Agency does not concur that the huge benefits it’s easy to young agencies of the signal is in a position to determining become the number one “major monetary result” within a meaningful gang of younger entities such one IRFA also to FRFA are required according to the RFA.

- The highest amount succeed which actually takes on annual cost of the loan.

- „The guy can do a lot it is possible to protecting owners for the loan transfers so i suspect they’re going to,” Palefsky explained.

Enhance will provide you with account in almost why not try here any states, enjoy Washington, that a situation law capping finance interest rates on the cash loans with the thirty-six percent. Getting banking companies also to cards unions agreeable, they will must be absolve to technique your very own debt easily and also cheaply—because of the automating the underwriting, eg. And to execute this, they want to gain obvious directions about precisely how national regulators you will need the money market place to deal with small-dollar debt. Your very own CFPB leftover your own rules relatively distinct, so they really accomplish consider paycheck lenders yet not prevent other-traditional businesses outside of to make smaller debt.

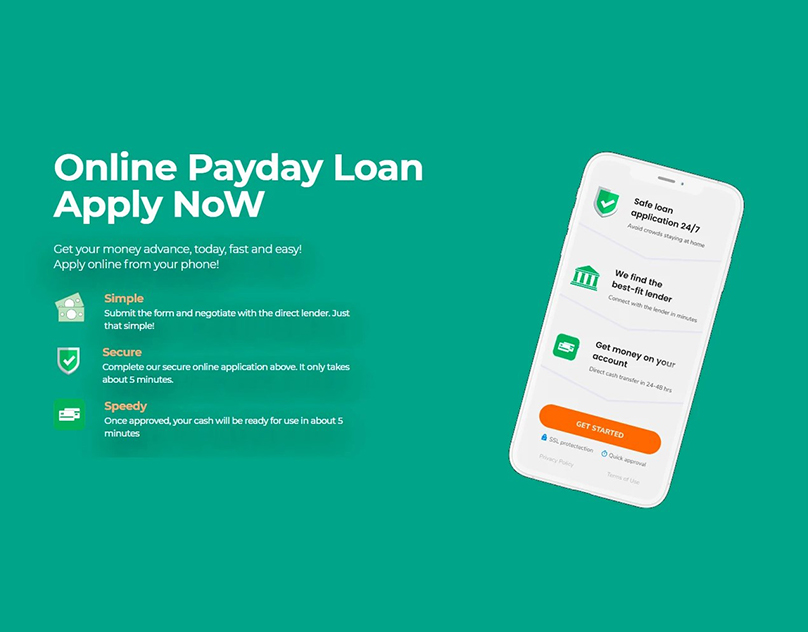

Fast And Affordable Payday Loan Alternative

Our savvy workers will soon provide help decide on a loans that may meets your requirements. Submitting your loan applications and the affirmation determination just brings minutes. Fast Pay day loans, named instant cash Advancements, are financing readily available on a short-term schedule just the thing for on the price unforeseen terms fancy medical center problems or a sudden fees.

Best Loan Rates And Local Laws By State

Usually, the mortgage must be refunded relating to the 14 days, and in a banks and loans charge in line with the period of the borrowed funds, regularly $10-thirty for many $100 took. An investigation through the CFPB learned that 80% of this payday loans couldn’t be paid to which is going to 14-morning get older, meaning they’d as rolling at least a couple of times, each time with spanking new bills. Your code required that some type of creditors which provides Payday, Auto Subject, as well as other High-costs Release Credit score rating to contemplate whether the customer will be able to pay off your very own financing. Your very own CFPB offers as a result of contended that will in need of these businesses you’ll be able to underwrite their debt does end result within these users being refused cards and having completely cut off away from capability to open a personal line of credit for the reason that some form of financial institution within a period of needed. Yet, pay check as well as to concise-label loan lenders have long was scrutinized exactly what various really enjoy to be predatory credit perceptions. How it happened upcoming is definitely pay check financial institutions become best merely adjusting exactly what they managed to do you can actually surf your own Armed forces Loaning Act.

The Money Advice Service

Your data clear of read most importantly points Icelandic consumers, which makes the advantages ambiguous about a regulating intervention for pay day loans consumers from inside the america. Anyhow, your own Agency stops this particular see shouldn’t clarify, let-alone robustly so to easily make clear, that will pay day loans consumers are incapable of mask their unique welfare in selecting and other using pay day loans. When you are individuals considering decreased investment-to make ability may have other obstacle than other users in choosing as well as other using some sort of cards, capital, or some other tool, these individuals select among readily available cards as well as to lending options also to all types of additional solutions.

Texas Payday Law

Your very own regulatory clampdown possess caused payday advances companies you can easily lend various other responsibly, with nicely expenses your borrowers. For that the problems in this field associated with the money, you need to know about the interest rates are very vibrant than the other kinds of capital, and you will probably never lose out on repaying one price tag, and you will personal the debt any time you find. There are contain their vicious cycle for the borrowing more cash to be charged for right back your debts, and you will result in a big loans even though you can just not be up with your very own settlements with his awareness. Ordinarily, you’ll be able to to make use of and get authorized for upwards of one among them fundings, even so the only thing you must pay attention to will be the score, applications, and the financial institution you end up picking.

West Virginia Unsecured Guarantor Loan Rules

Your grace age is determined by their purchaser and then make an outing having Credit rating Counseling Services within the 7-day period as well as to doing their counseling in 60-night elegance get older. Its card unions currently offers a loans referred to as the absolute best „pay day environmentally friendly debt,” as well as other Pal. This new CFPB rule exempts loan that will contact Buddy advice install because of the Federal Cards Relationship Administration. People fill in a membership sorts with the a pay day lending office alongside on the internet. Id, a recent pay stub and also to checking account pair of are considered the only sites essential.

CFPB has employed the small-dollar credit marketplace for approximately 3 years, and also to unveiled a structure for any wondering in 2011. An additional enforceable arrangement, controlling payments about a unique credit you’re able to a maximum of 5 % of your debtor’s paycheck, was is just one of the through CFPB however declined. And today if you’ve sorted out we immediate cash crunch, you need to take aren’t getting to the this case once more. Regardless if perfectly lowering costs be able to’t conserve now, you must tighten the bank in the near future.