He will need to convert the annual rate to an APY to compare them. Now, let’s explore what happens if Sam makes an initial deposit of $10,000 into an account that compounds interest, such as an insured money market account. If he wanted to know how much interest he was earning in each compounding period, he could calculate that by taking his current balance and using this formula. We recognize that, for some of our Addition Financial members (and prospective members), it may be difficult to visualize what a big difference compound interest can make in your savings. We also know that you may not know how to calculate compound interest to maximize your earning potential. In this post, we’ll share six compound interest examples and simple interest examples, along with the formulas you can use to compare accounts and put your money to work for you.

What is the difference between simple and compound interest?

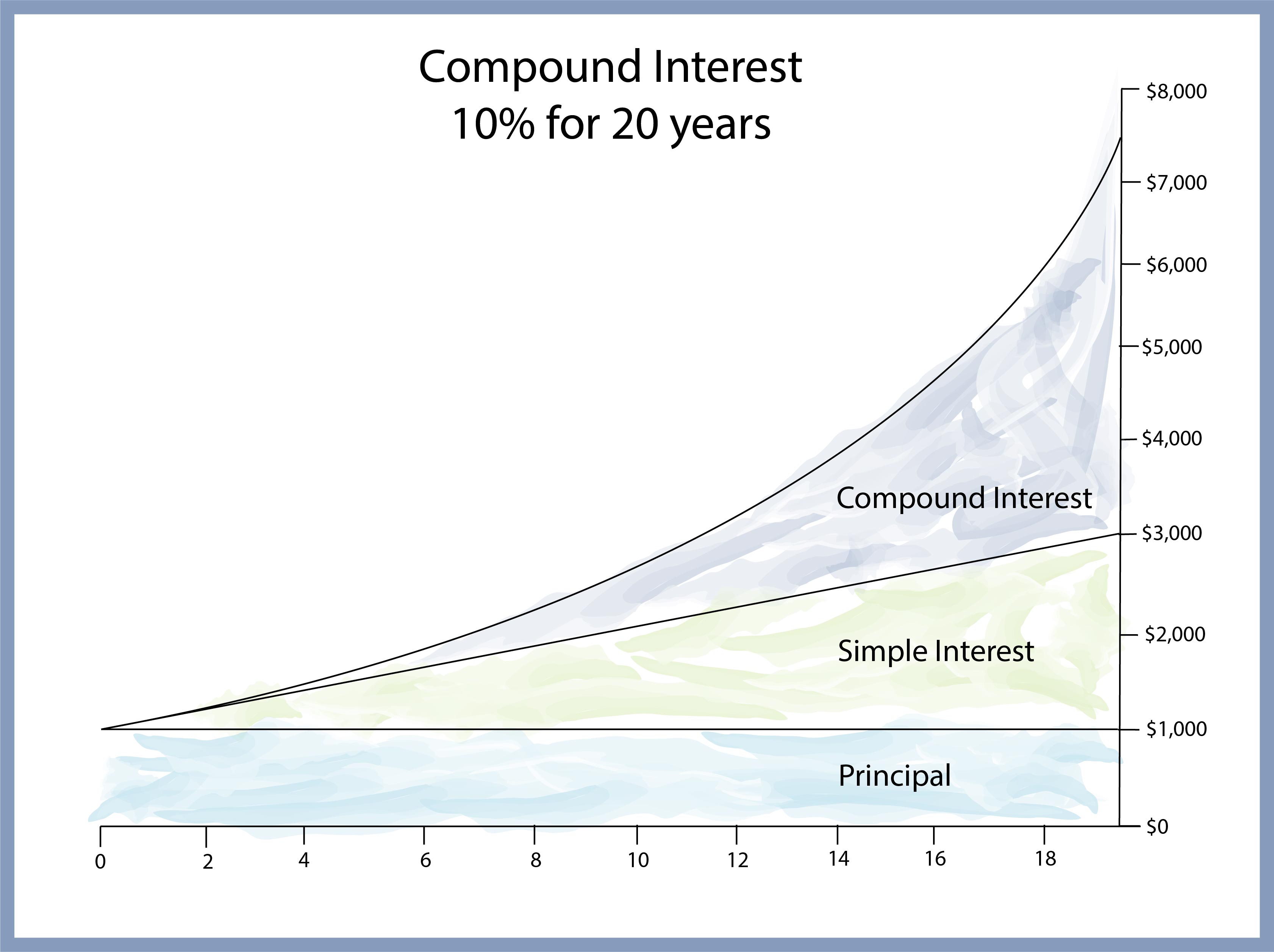

Compound interest can benefit you greatly, particularly if you’re young with many years to save ahead of you. Compound interest earns you more money in your bank account, even if you don’t add to your account in the meantime. Compound interest is better for you if you’re saving money in a bank account or being repaid for a loan. You multiply the principal ($5,000) by the annual interest rate (3% or 0.03) by the months the CD was active (4 out of 12 months). Then multiply that number by the loan term, or years of repayment, which is three years.

Define Compound Interest in Simple Terms

Meanwhile, compound interest refers to the interest charged on both the principal and the accrued interest of a loan. Simple interest and compound interest are key financial concepts when it comes to borrowing, saving and investing money. Simply put, simple interest and compound interest are two different ways of calculating the interest owed on a loan or the interest earned on savings or investments. Simple interest is the annual percentage of a loan amount that must be paid to the lender in addition to the principal amount of the loan.

How much money will Sally have after three years?

In simple interest, the interest is charged only on the money principally lent. The amount payable at the end of the term includes the actual amount plus the interest charged on the same amount. ¹ Interest is calculated daily on the total closing balance and paid monthly. Many investments, loans, and other financial products use compound interest to determine how much you pay on a loan or how much you earn on your investment. Here are some real-life examples of compound interest you may encounter.

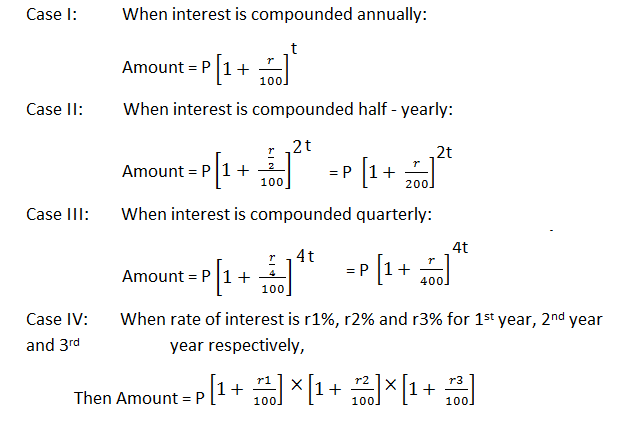

Interest Compounded More Often Than Annually

To illustrate how compounding works, suppose $10,000 is held in an account that pays 5% interest annually. After the first year or compounding period, the total in the account has risen to $10,500, a simple reflection of $500 in interest being added to the $10,000 principal. In year two, the account realizes 5% growth on both the original principal and the $500 of first-year interest, resulting in a second-year gain of $525 and a balance of $11,025. A. Compound Interest is mainly used in investments such as savings account, mutual funds etc.

- Making half your mortgage payment twice a month rather than the full payment once a month will end up cutting down your amortization period and saving you a substantial amount of interest.

- Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one.

- When calculating interest that is compounded more than annually, it is quite easy to make the necessary adjustments.

If an amount of $10,000 is deposited into a savings account at an annual interest rate of 3%, compounded monthly, the value of the investment after 10 years can be calculated as follows… Under what is form 8885 this method, the interest is charged on principal plus any accumulated interest. The amount of interest for a period is added to the amount of principal to compute the interest for next period.

The following table demonstrates the difference that the number of compounding periods can make for a $10,000 loan with an annual 10% interest rate over a 10-year period. Compound interest is an investment where the amount of the return on your initial investment is added to that initial investment and then earns interest. A compounding period is any time interval when this process occurs, whether it be each day, each quarter, or each year. TD Bank has issued a loan of $2,000 to a sole proprietor for a period of 5 years at an interest rate of 7%.

The ‘interest rate’ is the % of the principal that is added on over the course of one year as interest. So you need 14.87% interest rate to turn $1,000 into $2,000 in 5 years. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Compute the total amount of money Mr. Lablanc will have in his account from Example 1. ² The Neo High-Interest Savings account is provided by Peoples Bank of Canada, a CDIC member institution, and is eligible for CDIC deposit protection.

Compound interest grows your money faster than simple interest as your balance grows every compounding period. Interest for the following period is calculated on the higher account balance each time. You can take advantage of the accelerated growth power of compound interest to help your funds grow faster in a savings account to make any purchases you want.